The tumultuous waves of the U.S. stock market, particularly concerning the artificial intelligence (AI) sector, have been a topic of heated discussion among investors and analysts alike. Following a dramatic decline in early August, the leading companies in the AI domain experienced a significant rebound in their share prices. The fluctuations of stocks such as Nvidia, Microsoft, Google, Meta, and Apple during this period serve as a critical case study for understanding the current landscape of technology stocks and the implications of AI hype.

On August 5, Nvidia shares were trading around $100, and by August 28, they soared to $128.3. Similarly, other tech giants saw their prices recover, with Microsoft surging to approximately $413.84 from a drop below $400, Google climbing to over $190 from below $160, and both Meta and Apple witnessing uptrends as well. The resilience displayed by these stocks highlights the premium investors place on the potential of AI technologies, despite the underlying volatility.

However, as stock prices rebound, there have been signs that some seasoned investors are choosing to pull back. Notably, Warren Buffett has reportedly sold off approximately half of his holdings in Apple, prompting speculation about the sustainability of the current market dynamics. Simultaneously, Nvidia’s CEO, Jensen Huang, has cashed out significant amounts of stock, totaling about $520 million over the past three months, suggesting a lack of confidence in the inflated valuations.

In a broader economic forecast, veteran strategist David Roche warned of a potential bear market in 2025, predicting a decline of around 20%, with AI stocks possibly contributing to this bubble. The question arises: is the current enthusiasm surrounding AI stocks merely based on speculative fervor, or is there a substantive growth trajectory being established?

Among the standout performers, Nvidia’s growth has been extraordinary, with a staggering 144.12% increase in share price since the beginning of the year, up over sevenfold compared to early 2023 values. The peak for Nvidia occurred in June, when shares hit $135.58, pushing the company’s market capitalization to $3.335 trillion. Similarly, Microsoft, Apple, Google, Meta, Amazon, and Tesla each experienced considerable surges in mid-2023. It’s essential to understand that such performances often correlate with investor sentiment surrounding the AI boom, which many perceive as the next technological wave, driving both public and private investments into this domain.

Examining the Price-to-Earnings ratios can provide insight into the valuation of these tech stocks. Over the past five fiscal years, Google has seen its ratio decrease slightly, while others like Apple, Microsoft, and Nvidia have seen considerable increases. Nvidia, in particular, boasts the highest P/E ratio among its peers, suggesting that while the market is enthusiastic about its potential, investors should exercise caution regarding overvaluation risks. Qu Shaojie, an assistant general manager at Great Wall Fund, notes, "A P/E ratio above historical averages indicates potential overvaluation, although it has recently aligned closer to the mean, suggesting a healthier market." This observation reflects an ongoing debate about whether current valuations are justified or are the product of excessive speculation.

Analyzing the influx of capital into these tech giants provides an understanding of market psychology amidst an environment of rising interest rates. Zhang Chi, chairman of a Capital Management firm, emphasizes that fluctuations in stock prices do not always align with operational performance; rather, the flow of capital is often dictated by investor sentiment toward high-growth sectors like AI. As capital pools into these tech giants, any significant downturn in one could trigger a domino effect, jeopardizing the entire market. Despite the recent rally in prices, Zhang believes a more serious correction may be forthcoming as the market becomes conscious of the limited avenues for monetizing AI products in the short term.

The divergence in perspectives among industry experts is intriguing. Some, like Silicon Valley investor Zhang Lu, argue that many tech giants haven’t truly reached inflated multiples; instead, they are benefiting from robust growth rates. The pressing question remains as to how quickly AI can deliver concrete value to businesses. Zhang advocates for a balanced approach: investing in established leaders while examining their ability to adapt and leverage AI technologies effectively.

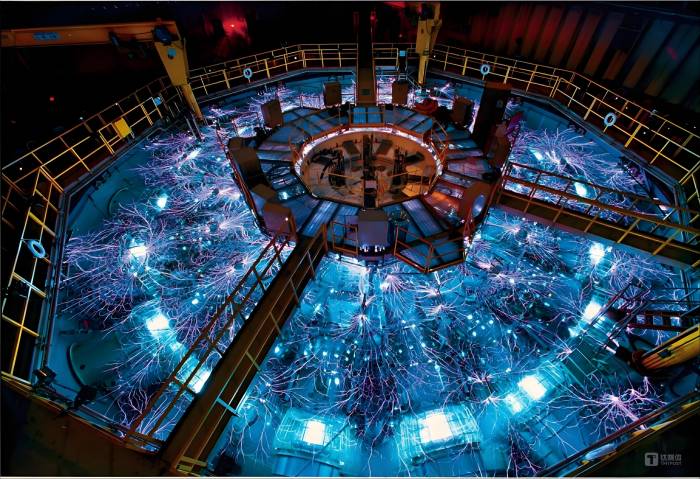

The emergence of ChatGPT at the end of 2022 signified the dawn of generative AI, a sector that largely influences today’s perception of artificial intelligence. As the tech industry assesses the 'AI content' embedded in the "Fab Four" and other tech stocks, disparities emerge. These companies can be segmented based on their AI infrastructure capabilities, with some serving as foundational players supporting AI development.

Nvidia leads this pack, with an annual revenue growth of 126% in its latest report attributed largely to AI-driven demands in data centers. Comparatively, while AMD has seen comparable growth, a significant portion of its revenues still derives from CPU sales rather than being fully reliant on its GPU-centric offerings. Major cloud service providers like Microsoft, Google, and Amazon are not directly tied to AI revenues yet are uniquely positioned within the ecosystem, potentially benefiting from the AI revolution.

The second category comprises firms that are firmly applying AI in their business models, evident in Meta's advertisement revenue jump of 21.7% in a challenging market. However, while Meta, Google, and Microsoft show potential associations with AI-driven revenue growth, the extent to which AI has tangibly impacted sales remains uncertain.

Apple occupies a unique space in this discussion. Although AI technologies have yet to drive transformative changes in their core business model, industry watchers await developments surrounding Apple Intelligence and its implications for hardware sales.

In analyzing these tech giants’ capital expenditures relative to their income and profitability, patterns reveal a potential mismatch. For instance, Alphabet's capital expense in Q2 2024 surging to $13.2 billion, with Meta's forecasted jumps in spending, contrasts with slower income growth rates. A stark focus on capital investments might not immediately translate to revenue and profitability, raising concerns about the sustainability of such expenditures without aligned growth.

The central question remains: can this tech rally endure, or is it built on shaky foundations? Analysts warn that the market must navigate beyond mere operational performance assessments and into the realm of broader market sentiment and the trajectory of global capital flows. The high valuations observed may not withstand a downturn if macroeconomic conditions provoke investor panic.

As the U.S. economy potentially gears itself for interest rate cuts, the decisions of institutional investors will play a crucial role in shaping future market landscapes. As the ongoing market oscillations unfold through the second half of the year, addressing whether innovation can keep pace with high expectations becomes critical. If innovation fails to meet speculative enthusiasm, the consequences may lead to a more pronounced correction, threatening the stability achieved in the recent recovery.

Ultimately, the discourse surrounding these tech stocks encapsulates a broader narrative within the financial ecosystem—a dance between optimism for the future of AI and the grounded understanding that irrational exuberance may lead to significant market corrections, as history has shown.

Join the Discussion